0 comments

Last week in Part I of this two part series, I laid out the facts regarding the Micro-mobility trend that is sweeping the country. Today in Part II, I will dig into the economics of this trend, are all these companies in a race to the bottom just like Uber & Lyft with their respective rideshare businesses? Will they ever be profitable? What is the effect of e-scooters on the every day rideshare driver?

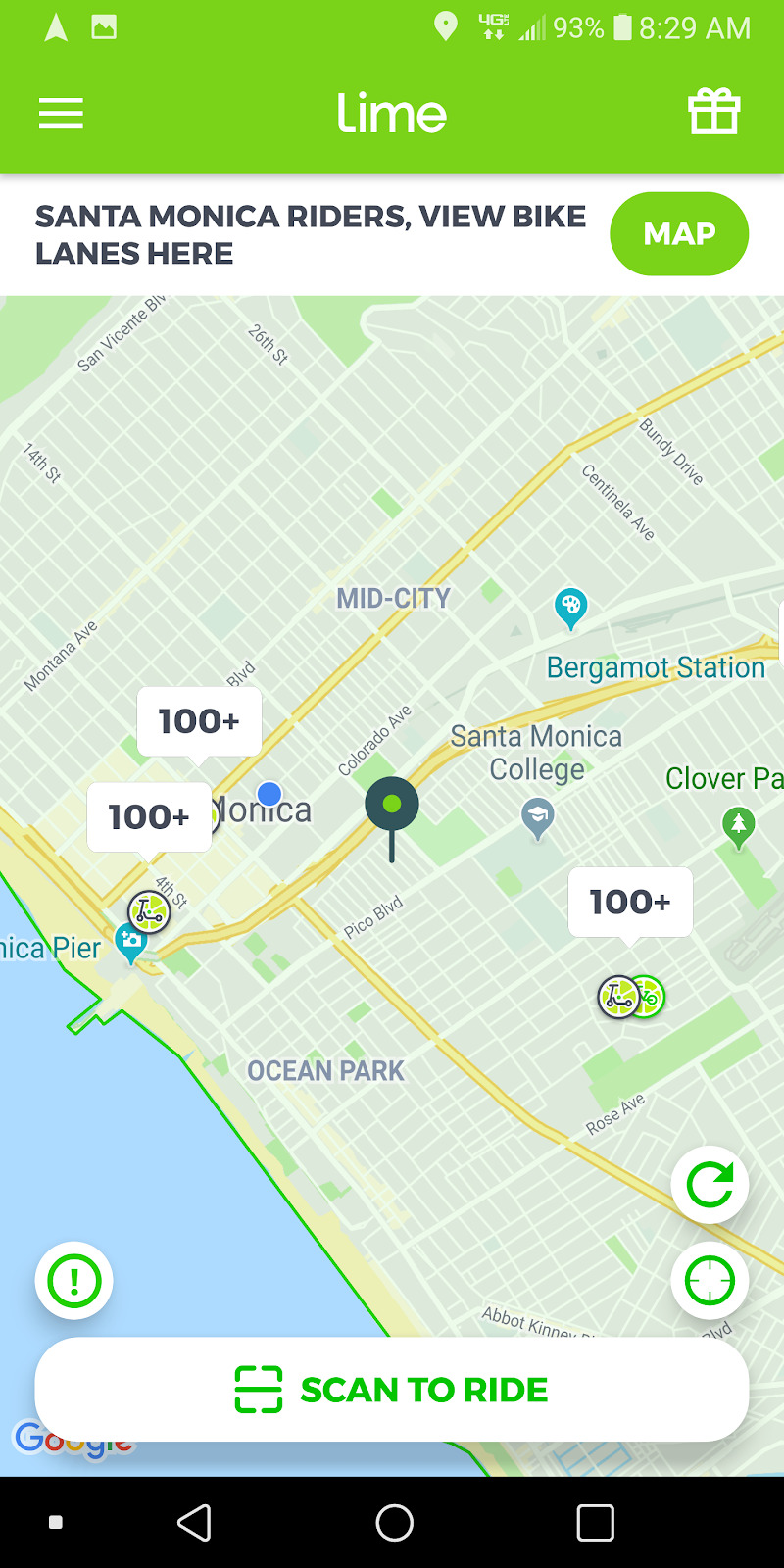

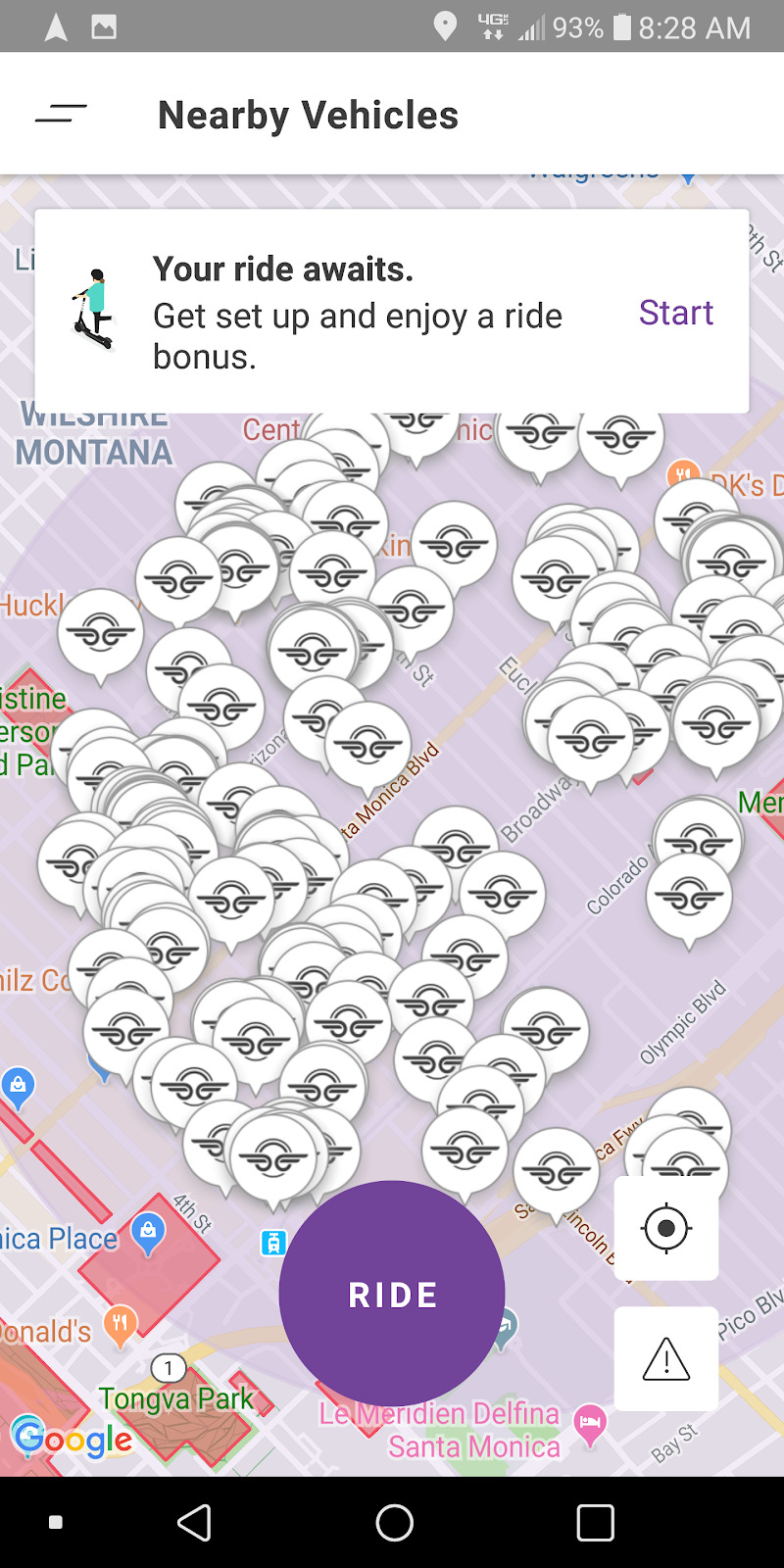

These are e-scooters dumped by riders on a walkway in Santa Monica, CA. The cities are struggling creating laws to regulate them, the residents are up in arms since they are literally dumped where the rider steps off. In Part I of this series, I had posted a few screenshots of electric scooters and e-bikes from Uber, Lyft, Bird and Lime rider apps. There are so many lining up the sidewalks that it is becoming a game of dodgeball to maneuver amongst them.

At the moment the numbers don’t really add up for Bird or any other player in this market to deserve unicorn valuations because scooters don’t bring in nearly enough money to even cover a quarter of their purchase price. Ride-sharing as proven by Uber & Lyft over the past six years is based on a flawed business model and wildly unprofitable even with massive subsidies. If Bird, Lime, Wheels, Jump, Scoot, Uber and Lyft continue to copy the playbook of the rideshare business, it’s entirely possible that these electric scooters will end up in a mass graveyard dragging their VC with them.

It all comes down to unit economics, how much revenue each individual scooter brings in for the company and the most important number to consider is how long these e-scooters last. The more trips and miles a single scooter can cover, the better it is for scooter companies in order for them to recoup the cost of each vehicle before they can be profitable.

At the moment these e-scooters roughly cost between $500-$700 a piece. Prices have been coming down since mass purchases are being made by all the brands mentioned above. Over time Bird, Lime and many others are hoping to manufacture their own scooters for less than $300. Scooter companies are flooding cities with unlimited supply of units, perhaps with the assumption that their ubiquity will increase utilization.

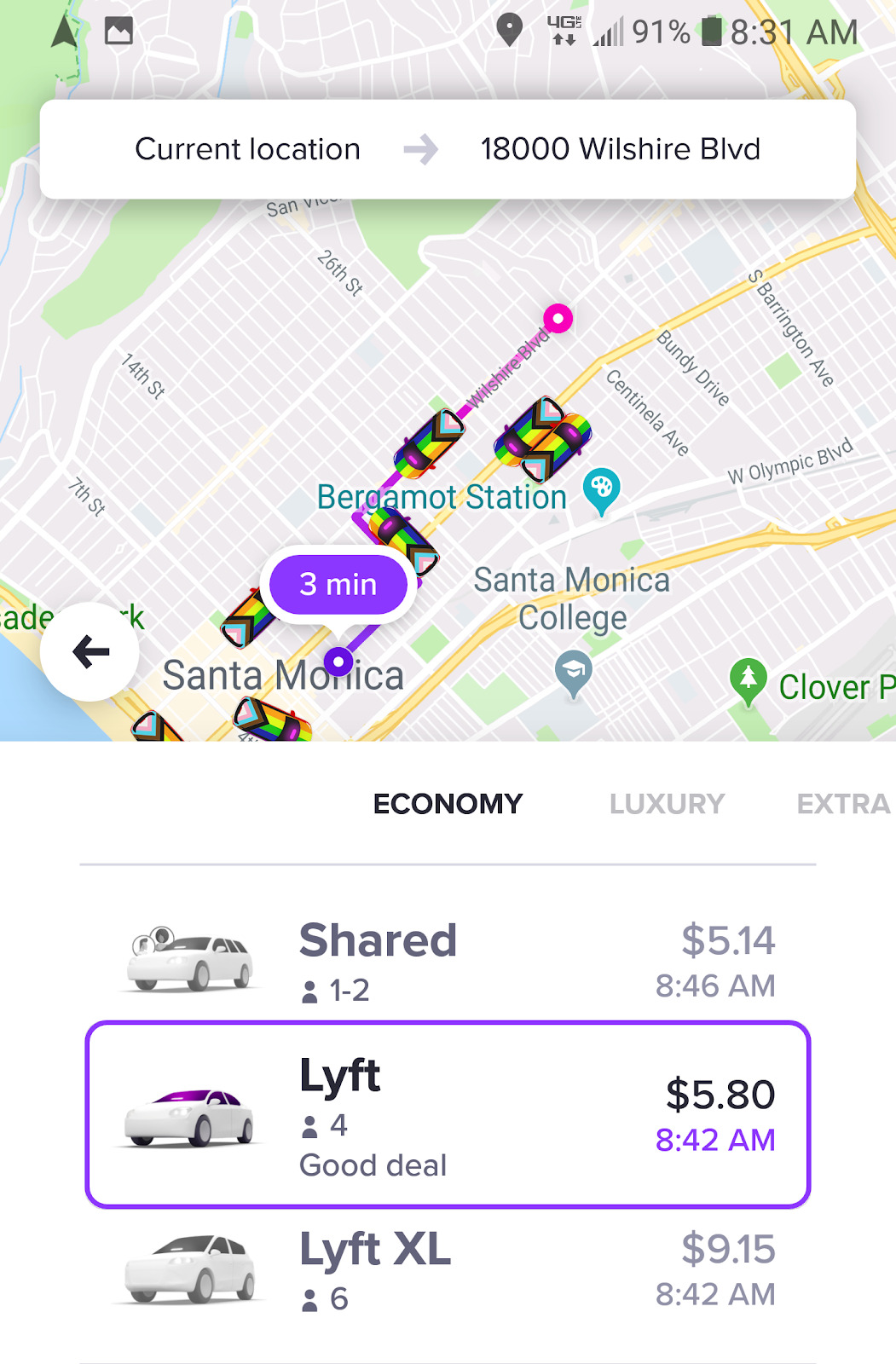

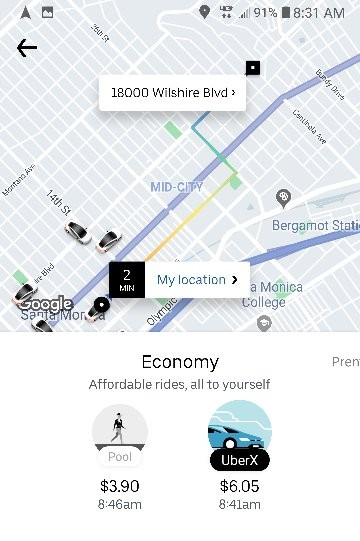

Let’s take Bird’s published numbers. An average trip lasts about 18 minutes and each e-scooter is utilized for about 3.5 rides a day. Take a look at the screenshots below, with an over saturated market, unit utilization is surely to go lower unless everyone decides to switch from using Uber/Lyft cars to scooters, in which case Uber and Lyft are clearly cannibalizing their existing rideshare business.

Bird charges $1 to unlock and 23 cents (just raised the rates from 15 cents per minute) per minute. Factoring in the averages, here's the math. Without promotions, each rider pays roughly $5.14 per trip, multiply that by 3.5 trips per day per e-scooter, and Bird generates $17.99 gross profit unit/day. The costs involved in operating a mass fleet of e-scooters is pretty much fixed. It takes $1.72 (Bird fetchers and Bird releasers get paid an average of $5-7 per unit) per ride on charging costs, Bird spends another 51 cents per ride on repairs, credit card fees cost 41 cents a ride, and finally CSR adds 6 cents to each ride and liability insurance adds 10 cents. They have not released what it takes to operate the platform regarding their employee headcount/compensation, office leases etc. since they are still a private entity.

Totaling all of the expenses above, we arrive at an operating cost of $2.80 per scooter. $5.14-$2.80=$2.34 is the net profit for each unit. $500 (optimistic unit purchase price) / $2.34 of net profit=Scooter pays for itself after 213 days.

Here is the bad news, average scooter lifespan under the most optimistic assumptions is estimated to be roughly 60 days. They are constantly vandalized, torn apart by rough riders and stolen. Granted, they are improving safety measures but none of them have been enough of a deterrent for theft to subside. 60X$2.34=$140.40, that is where the buck stops. As it stands, all e-scooter companies are losing an average of $360 or more per scooter. Perhaps flooding the streets with scooters is a good short-term strategy to increase revenues and attract VC funding, but it is a very poor strategy for the longer term.

If you read Uber & Lyft pre IPO S1s, you’ve now realized that both have a meaningful part of their business tied up in rides that are sub 3 miles. Average length of ride on each platform is around 6-7 miles.These are the local trips that tend to add to congestion and are the ones that are most vulnerable to alternate forms of transportation such as electric scooters and e-bikes but these short rides are also extremely profitable for Uber & Lyft.

In the screenshots above, the cost for an UberX was $6.05 and regular Lyft for the passenger was $5.80 with the driver getting a life changing $2.62 (minimum fare pay). Uber/Lyft’s hold on this ride was $3.18-$3.43, a whopping 54-58%. Drivers loathe these rides since they are mostly money losers. So if Uber & Lyft decide to cannibalize the most profitable part of their business by moving everyone to ride e-scooters versus cars, so be it. Not a big loss for the drivers all over the country. Would you rather ride an e-scooter or order a car for about the same cost on your next short trip?

What do you think of the business model for e-scooter companies like Bird, Lime, Uber, Lyft, Jump? Is the Micro-mobility trend going to be centers for profit or like rideshare another way of losing money?

No comments yet. Be the first!